Economic interactions and flows

The Rostow model

Source: http://www.geographyalltheway.com/in/ib-global-interactions/transfer-capital.htm

Source: http://www.thegeographeronline.net/economic-interactions-and-flows.html

Source: http://www.geographyalltheway.com/in/ib-global-interactions/transfer-capital.htm

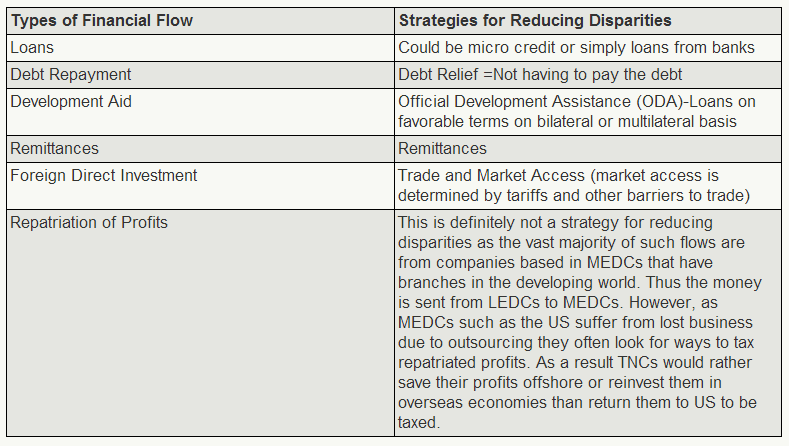

Financial flows

Source: http://www.thegeographeronline.net/economic-interactions-and-flows.html

Loans and debt repayment

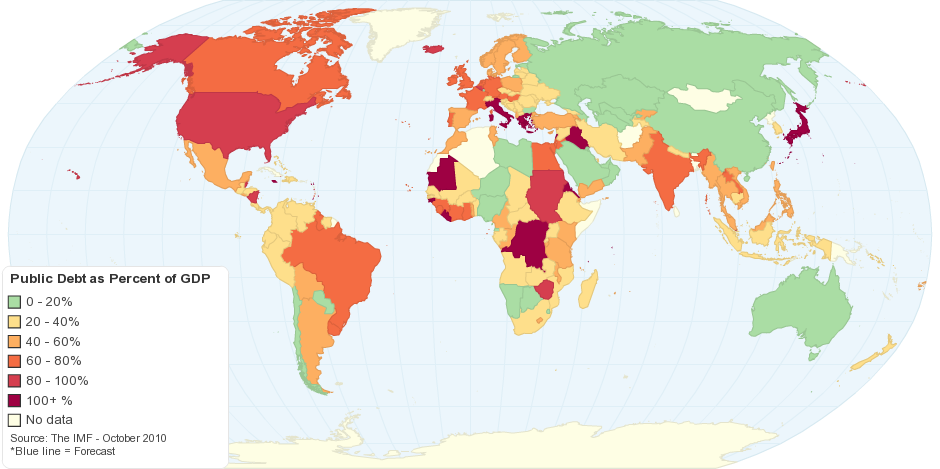

Individuals, companies and countries often have to borrow money in order to finance their operations. For example most individuals will take a bank loan (mortgage) at some point in order to buy a house. Companies may take loans in order to buy new equipment, build a new factory or buy supplies. Countries may have to borrow money to fund infrastructure projects, pay welfare benefits or even to fund a war. Individuals and companies will normally take loans with private banks e.g. HSBC or Citigroup. Countries may also borrow money from private banks or other financial institutions like the IMF or issue bonds to be sold to private investors (individuals and countries).

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Source: http://chartsbin.com/view/2108

Source: Nagle, Garrett and Briony Cooke. Geography Course Companion. Print.

Many LEDCs have high levels of debt. The high levels of debt often came about from money borrowed after their independence (borrowed from private MEDC banks, IMF and World Bank). There have been recent attempts to help countries with high debt. Two schemes aimed at reducing debt are:

HIPC: The highly indebted poor countries scheme was initiated by the IMF and World Bank in 1996. Countries with unsustainable debt burden were give low interest loans or debt cancellations as long as they followed reforms like reducing corruption and promoting democracy.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Source: http://greenfieldgeography.wikispaces.com/Reducing+disparities

Jubilee 2000: This was an international coalition that hoped to reduce or cancel third world debt by 2000. Its aim was to cancel $90 billion of world debt.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Source: http://advocacyinternational.co.uk/featured-project/jubilee-2000

Aid

Source: http://ibis.geog.ubc.ca/courses/geob370/students/class09/spdueckm/aid.html

Official Development Assistance (ODA): This is the term that the Development Assistance Committee (DAC) of the OECD has given to official aid.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Remittances

Remittances is money sent home to friends and family by migrants living elsewhere (often in a foreign country). Remittances can be a very important source of income for LEDCs. In 2007 the World Bank estimated that remittances sent around the world totaled over $250 billion, with most flows going from MEDCs to LEDCs. Remittances can be beneficial because money goes directly to people that need it rather than through governments. It also means that money is spent how people want it to be spent. However, reliance on remittances can create dependency, they are vulnerable to changes in exchange rates and they can fall significantly during economic downturns.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Source: The Economist, 28th April 2012. http://im-an-economist.blogspot.com.br/2012/05/graph-of-week-remittances.html

Foreign direct investment (FDI)

Most countries want to attract FDI because it helps their economy grow and creates jobs. LEDCs can present themselves as attractive locations for FDI because of the potential profits. Enterprises that have been invested in, in LEDCs may present high levels of profit because of:

Cheap labour

New markets

Low taxation

Cheap land and resources

Relaxed planning and environmental regulations

However, despite attractions, it is still MEDCs that receive the most FDI. LEDCs can miss out on FDI because of:

Unstable or corrupt government

Poor transport and communication links

Poverty reducing potential market

Complicated regulations in foreign languages

Unstable currencies or economies

Some growth economies and emerging markets like China, India and Brazil are seeing increases in FDI, but until LEDCs are able to improve their economies and infrastructure they will continue to lose out to MEDCs. It must also be remembered that FDI can cause problems and is not always advantageous. Problems may include increased pollution, inflation, exploitation of resources, economic leakage and closure of local industries.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Repatriation of profits

Profit repatriation: returning foreign-earned profits or financial assets back to the company's home country.

Source: http://www.thegeographeronline.net/economic-interactions-and-flows.html

Transnational corporations are companies that operate in more than one country. Normally they will have their headquarters in their country of origin and will repatriate most of their profits back to this location. They will then often have research and development (R&D) facilities in MEDCs where there is skilled labour and high levels of technology. Manufacturing plants will often be built in countries where production costs are lowest or markets strongest. Retail outlets will be placed in any country that has a potential market.

The World's biggest TNCs have traditionally been from MEDCs like the US, Japan, the UK and Germany. However, some of the World's biggest TNCs are now from emerging markets like China and Brazil. In the future there are likely to be a lot more from these countries as well as countries like Russia, India and Indonesia. These countries are going to see a growth in their TNCs because they have huge domestic markets and their products will improve in quality and recognition.

Traditionally, oil, banking and car companies have been the biggest TNCs in the World. However, with changing technology and improving living standards, other TNCs like pharmaceuticals, electronics and retail are appearing.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

The influence governments have in the transfer of capital

The aim of all national governments is either to try and balance their budget or to get a budget surplus (unfortunately most countries run a deficit). As well as balancing spending and taxation governments also need to look at the their levels of imports and exports. Governments can increase or decrease imports and exports in some of the following ways

National governments can try and increase flows of global trade in a number of ways including:

- Joining a trading bloc or trading organisation

- Promoting free trade and ending protectionism

- Opening enterprise zones and attracting TNCs

- Devaluing their currency

They can also try and reduce flows of global trade in some of the following ways:

- Using protectionist measures (tariffs and quotas)

- Imposing sanctions or embargoes with other countries

- Switching to more planned economies

- Increasing regulations and environmental controls (more red tape)

- Imposing ownership regulations on foreign companies

Source: http://www.thegeographeronline.net/economic-interactions-and-flows.html

The influence world trading organizations and financial institutions have in the transfer of capital

World Trade Organisation (WTO)

The WTO started its life as GATT (General Agreement on Tariffs and Trade). GATT was established in 1948. GATT involved member countries meeting (rounds) to discuss and agree tariffs over trade. The final round in Uruguay (1986-94) agreed to establish its successor the WTO. The WTO officially began life on the 1st January 1995. The WTO Is based in Geneva and now has 153 members who between them represent 97% of total world trade. Although GATT only looked at the trade of goods, the WTO also looks at the trade of services and intellectual property rights. The aim of the WTO is to:

- Liberalise (free) world trade (reduce protectionism)

- Create a forum for governments to negotiate global trade agreements

- Be a place to settle trade disputes

- Be a place to set and clarify trade rules.

The WTO's most recent negotiations were in Doha, Qatar. The aim of the negotiations was to involve LEDCs more in global trade. One of the major sticking points in the talk was Europe's and the US's refusal to cut farm subsidies.

Despite its work, the WTO has had some critics. It is criticised for favouring MEDCs especially over its agricultural subsidies, allowing counterfeiting and breaking of copyright/patents to continue in member countries and having no power to punish countries who break trade rules

International Monetary Fund (IMF)

The IMF like the World Bank was created at Bretton Woods in 1944. It started with only 46 members but has now grown to include 186. Member countries all contribute to a pool of money which member countries can then borrow on a temporary basis to overcome budget deficits/imbalances. The IMF was extremely important after WWII to help stabilise the global economy.

The IMF has taken a leading role during the current global economic crisis. It has sold gold reserves to increase it pool of money and the G20 leaders have pledged a further $500 billion to allocate to other members suffering from budgetary problems. Even though the IMF is currently taking a leading role in the economic crisis, it has been heavily criticised. Criticisms include:

- The IMF have supported some undemocratic governments that have been favourable to European and US TNCs.

- SAPs imposed on borrowing countries were often damaging, forcing countries to sell state assets and to cut funding to education and health.

- The IMF has forced countries to impose strict austerity measures in order to receive money (increased taxes and reduced spending). Greece has had to follow very strict austerity measures to get help from the IMF and EU.

- The main funding nations (MEDCs) have too much influence over decisions.

- The head of the IMF always comes from Europe

- That it often has reactionary policies rather than preventative ones.

World Bank

The World Bank was established in Bretton Woods in 1944 and has its headquarters in Washington DC. The World Bank is not a traditional high street bank, but a global one owned by its member countries (187 countries). It has two main institutions, the International Bank for Reconstruction and Development and the International Development Association. The bank has over 10,000 employees and over 100 offices around the world. In its early days the bank did not lend much money, but then in the late 1960's and 1970's it started lending more money to developing countries in order to fund schools, hospitals, infrastructure projects, etc. In the 1980's the World Bank along with the IMF imposed SAP (structural Adjustment programmes) on many of its borrowers.

From the 1990's onwards the World Bank is now more interested in helping countries achieve the UN's Millennium Development Goals. This includes reducing poverty, improving health and education and ensuring sustainable growth.

The World Bank has had a number of criticisms including:

- Its imposition of policies on developing countries (particularly the damaging SAPs)

- Its assumption that LEDCs cannot develop without outside help and knowledge

- The largest contributors (MEDCs) have too much power over policies

- That the head of the World Bank always comes from the US

- That it focuses too much on GDP growth rather than improvement in living standards.

- Some development projects were environmentally damaging e.g. dams causing deforestation

- Some projects involved expensive technology which countries could not fund themselves.

Source: http://greenfieldgeography.wikispaces.com/Financial+flows

Labor flows - Poland to UK

In 2001 the UK Census showed that there were about 60,000 Polish born people living in the UK. However, by 2010 it was estimated that this figure 515,000 (some unofficial estimates say it is closer to 1 million). The large-scale migration started in 2004 when Poland and seven other countries (Estonia, Latvia, Lithuania, Slovakia, Slovenia, Hungary and the Czech Republic) joined the EU. Their membership of the EU gave Poles much greater freedom to travel, live and work in other EU member countries. Most Poles have applied and registered to work in the UK legally, but others have visited the UK and just not left - this is why the true number of Poles inside the UK is not fully known. Poles may not officially register to avoid paying tax on their earnings. Many of the unregistered migrants maybe working in farming. Farm working is very seasonal, so these workers may spend a lot of time moving between jobs and also returning home in between seasons. Most Poles have migrated because they have better economic opportunities in the UK than Poland (although the current global recession has encouraged many to return home). Although the migration of Eastern Europeans has inflamed some nationalist sentiment, on the whole Poles contribute an awful lot more to the British economy than they take. Many of the people protesting against migrants would not do the jobs migrants do and would certainly not do it for similar pay and treatment (not necessarily by workers, but some members of the public).

Source: http://greenfieldgeography.wikispaces.com/Labour+flows

Information flows - ICT and outsorcing

Outsourcing: The process of taking internal company functions and paying an outside firm to handle them. The process of outsourcing part of your business operations to another company is known as subcontracting.

The reasons companies outsource can vary, but may include:

- To reduce costs

- To improve quality of service

- To access and benefit from outside expertise

- To avoid training costs

- To focus on core business

- To improve choice

- To reduce risk (less investment, less direct employees)

- Avoid pay health insurance, pension contributions, etc. for workers

In order for cities, regions or countries to become attractive locations for TNCs to outsource, they will have to fulfill numerous requirements including:

- Improving internet speed, capacity and reliability

- Improve language skills of workers especially in English

- Improve IT skills and understanding

- Train workers in culture and customs of potential customers home countries

- Ensure reliable telephone connections

- Offer 24 hour service - important the contracting company is in a different time zone or even hemisphere.

- Offer a high quality service cheaper than potential customers can provide themselves

Source: http://www.thegeographeronline.net/economic-interactions-and-flows.html

Source: http://greenfieldgeography.wikispaces.com/Information+flows

No comments:

Post a Comment